The Tokenomics of U2U Network is a crucial factor in building a decentralized blockchain platform, helping to maintain stability and sustainable development. Let’s analyze three notable aspects of U2U Network’s Tokenomics with the following detailed information.

Contents

- 1 Overview of U2U Network and Tokenomics

- 2 Analysis 1 – Distribution Structure of U2U Network’s Tokens

- 3 Analysis 2 – Governance and Decentralization in Tokenomics of U2U Network

- 4 Analysis 3 – Impact of Deflationary Mechanisms and Stability of Token Value

- 5 Factors Influencing the Success of Tokenomics in U2U Network

Overview of U2U Network and Tokenomics

U2U Network is an advanced blockchain platform aimed at building a robust decentralized finance (DeFi) ecosystem where users can engage in financial activities without relying on intermediary organizations. U2U Network not only provides traditional financial services but also extends into decentralized applications, creating a flexible and transparent trading environment.

The Tokenomics of U2U Network refers to the principles and strategies for managing tokens within the platform, including mechanisms for issuance, distribution, governance, and encouraging participation. Effective Tokenomics not only helps regulate token supply and demand but also creates incentives for development and maintains the stability of the blockchain ecosystem.

In this context, the Tokenomics of U2U Network serves not only as a financial management tool but also plays an important role in building a decentralized community, ensuring sustainable development for the platform, and providing long-term benefits for investors and users.

Analysis 1 – Distribution Structure of U2U Network’s Tokens

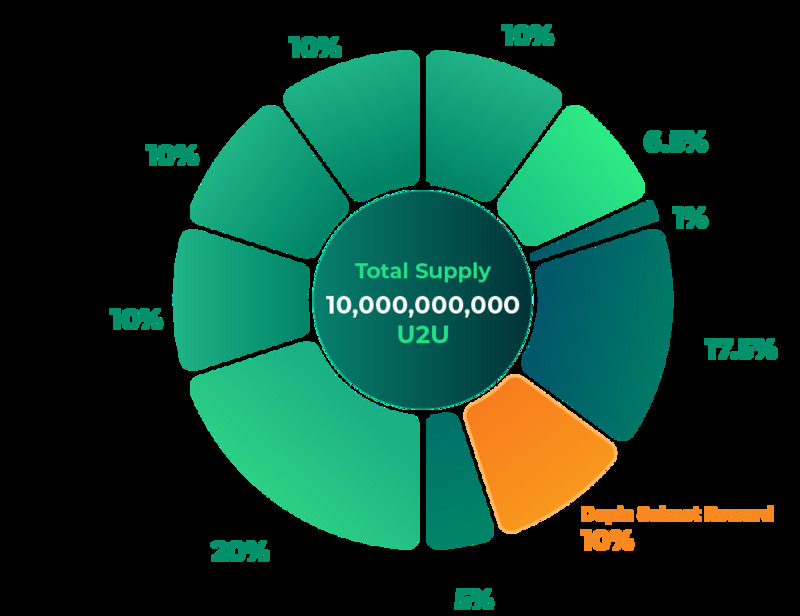

One of the key factors determining the success of Tokenomics is the method of token distribution. U2U Network has designed a meticulous token distribution structure to ensure fairness and transparency in asset allocation among participants. This structure not only helps maintain stability within the system but also creates incentives for investors and participants in the network.

Fair Distribution and Long-Term Strategy

The Tokenomics of U2U Network emphasizes fair and reasonable token distribution. A significant portion of tokens is allocated to the community, including airdrop programs, staking, and activities contributing to the platform’s development. This enhances community participation in the network and creates transparency in resource distribution.

Additionally, an important percentage of tokens is allocated to developers and strategic partners to ensure that key components of the network have sufficient motivation to continue developing the platform. Through this strategy, U2U Network encourages sustainable ecosystem growth while minimizing reliance on major investors.

Reserves and Token Regulation Mechanism

U2U Network also establishes a token regulation mechanism through reserve funds. These funds are used to respond to market fluctuations, ensuring that U2U Network’s ecosystem is not adversely affected by negative external events.

The reserve fund also helps maintain token value stability, ensuring that there are no sudden inflationary or deflationary pressures on token value.

Market Adjustment Capability

The Tokenomics of U2U Network is designed to flexibly adjust according to market conditions and user demand. The mechanisms for token distribution can change according to different phases of project development, ensuring that token issuance does not diminish its long-term value.

This is particularly important for keeping the ecosystem continuously growing and appealing to investors.

Analysis 2 – Governance and Decentralization in Tokenomics of U2U Network

One of the standout features of Tokenomics in U2U Network is its emphasis on decentralization and community governance capabilities. U2U Network adopts a decentralized governance model that allows community members to participate in important decision-making processes for the platform. This is a crucial factor in building trust and attracting users to engage with the ecosystem.

Decentralized Governance Mechanism (DAO)

The Tokenomics of U2U Network employs a decentralized governance model, meaning that decisions regarding development and changes within the ecosystem are made through a decentralized autonomous organization (DAO). Token holders can participate in voting to decide on issues such as adjusting token issuance rates, allocating resources, or even making decisions related to long-term development strategies for the platform.

The DAO model minimizes reliance on a centralized management group, creating fairness in decision-making processes and ensuring that decisions are made based on community interests.

Encouraging Community Participation

The Tokenomics of U2U Network encourages active community participation in governance activities. Token holders not only participate in voting but can also propose improvements or changes within the system. This creates an incentive mechanism for community members to contribute ideas and creativity, thereby helping the platform develop sustainably while meeting user needs.

Transparency in Management

The Tokenomics of U2U Network ensures that governance decisions are made transparently. All activities related to managing and developing the ecosystem are public and verifiable, giving users confidence in the transparency and fairness of the platform.

Analysis 3 – Impact of Deflationary Mechanisms and Stability of Token Value

The deflationary mechanisms and stability of token value are crucial factors in U2U Network’s Tokenomics. These factors help protect token value from market fluctuations and maintain attractiveness for investors.

Deflationary Mechanism (Token Burning)

The deflationary mechanism through token burning is an important strategy for maintaining long-term token value. U2U Network implements token burning at a certain rate, thereby reducing the total supply of tokens in circulation while increasing the value of remaining tokens. This mechanism creates scarcity while encouraging investors to hold onto their tokens rather than sell them off quickly.

Control Over Token Supply and Demand

By employing deflationary strategies, U2U Network can flexibly adjust supply and demand for tokens, ensuring that token value remains stable with an upward trend over time. This is particularly important in blockchain projects where rapid changes in token value can lead to imbalances within the ecosystem.

Creating Incentives for Investors

The deflationary mechanism and supply-demand control not only help maintain stability in token value but also create incentives for investors to engage with the project. When there is a scarcity of tokens and their value is protected, investors can see potential profit opportunities in the future and decide to hold their tokens long-term.

Factors Influencing the Success of Tokenomics in U2U Network

Several key factors influence the success of Tokenomics within U2U Network:

- A reasonable distribution structure helps maintain stability and fairness in resource allocation, thereby enhancing community participation.

- The DAO model helps maintain fairness and transparency in decision-making while encouraging community involvement in platform development.

- The reduction of tokens through burning and supply-demand adjustments helps protect token value while maintaining investor attractiveness.

- U2U Network can adjust its distribution and governance mechanisms to align with market demands and fluctuations, thereby sustaining long-term growth.

The Tokenomics of U2U Network plays an important role in building and maintaining sustainable development for this platform. According to Vitual Tech Vision, U2U Network’s Tokenomics not only helps regulate token supply and demand but also builds a strong decentralized community, ensuring long-term success for the platform.