As a small business owner, it’s essential to meet your customers where they are, and that includes offering convenient payment options. Mobile payments have revolutionized the way we pay for goods and services, providing a fast and secure alternative to traditional payment methods. In this article, we’ll explore what mobile payments are and how you can utilize them to enhance your business operations.

Contents

What is a mobile payment?

A mobile payment refers to a digital transaction method that utilizes smartphones or other mobile devices to make payments. This technology allows customers to pay for products or services quickly and conveniently. Mobile payments can be made through mobile wallet apps, peer-to-peer payment apps, or even via SMS. Some popular mobile wallet apps include Apple Pay and Google Pay, while peer-to-peer payment apps like Venmo, PayPal, CashApp, and Zelle are also widely used.

5 types of mobile payments

Mobile payments come in various forms, each with its unique features. Let’s explore the five main types of mobile payments:

1. Mobile wallet

Mobile wallet services such as Google Pay, Apple Pay, and Samsung Pay enable users to link their credit cards, debit cards, or bank accounts to their mobile devices. Once set up, customers can make payments by tapping their devices on payment terminals equipped with near-field communication (NFC) technology. Online, these mobile wallet accounts can be used on many merchants’ checkout pages, providing a seamless payment experience. Popular accelerated checkout apps like Shopify’s Shop Pay also function similarly to mobile wallets, allowing for speedy mobile payments.

2. Mobile ecommerce

Mobile ecommerce, also known as m-commerce, refers to any transaction conducted on a mobile device. Whether it’s making a purchase through a mobile browser or a merchant’s app, these transactions qualify as mobile ecommerce payments. Customers can complete mobile payments on ecommerce stores using their credit cards, mobile wallets, or accelerated checkouts like Shop Pay.

3. Mobile peer-to-peer

Mobile peer-to-peer payments enable individuals to transfer money to each other through mobile payment apps such as Zelle, PayPal, Venmo, and CashApp. These services are widely accepted by small business retailers, allowing customers to pay using these apps instead of credit cards.

4. SMS payments

SMS payments allow users to make payments by sending an SMS to a specific phone number. While less common in countries like the United States, SMS payments are prevalent in some developing nations.

5. Mobile payments at a point of sale

In a mobile point-of-sale (mPOS) scenario, customers can tap their credit cards or mobile devices on a mobile payment terminal connected to a tablet or smartphone. This method allows for contactless payments and offers flexibility in completing transactions. Shopify’s mobile POS, POS Go, allows businesses to accept mobile payments wherever they are. By activating Shopify Payments on your store and installing the Point of Sale channel, you can harness the power of mobile payments with ease.

Benefits of mobile payments

Accepting mobile payments provides several advantages for both businesses and customers. Let’s explore some key benefits:

Convenience for the customer

Mobile payments offer a seamless and convenient checkout experience for customers. Whether they’re tapping their devices at a point of sale or making online transactions, mobile payments eliminate barriers and streamline the purchasing process.

A secure payment method

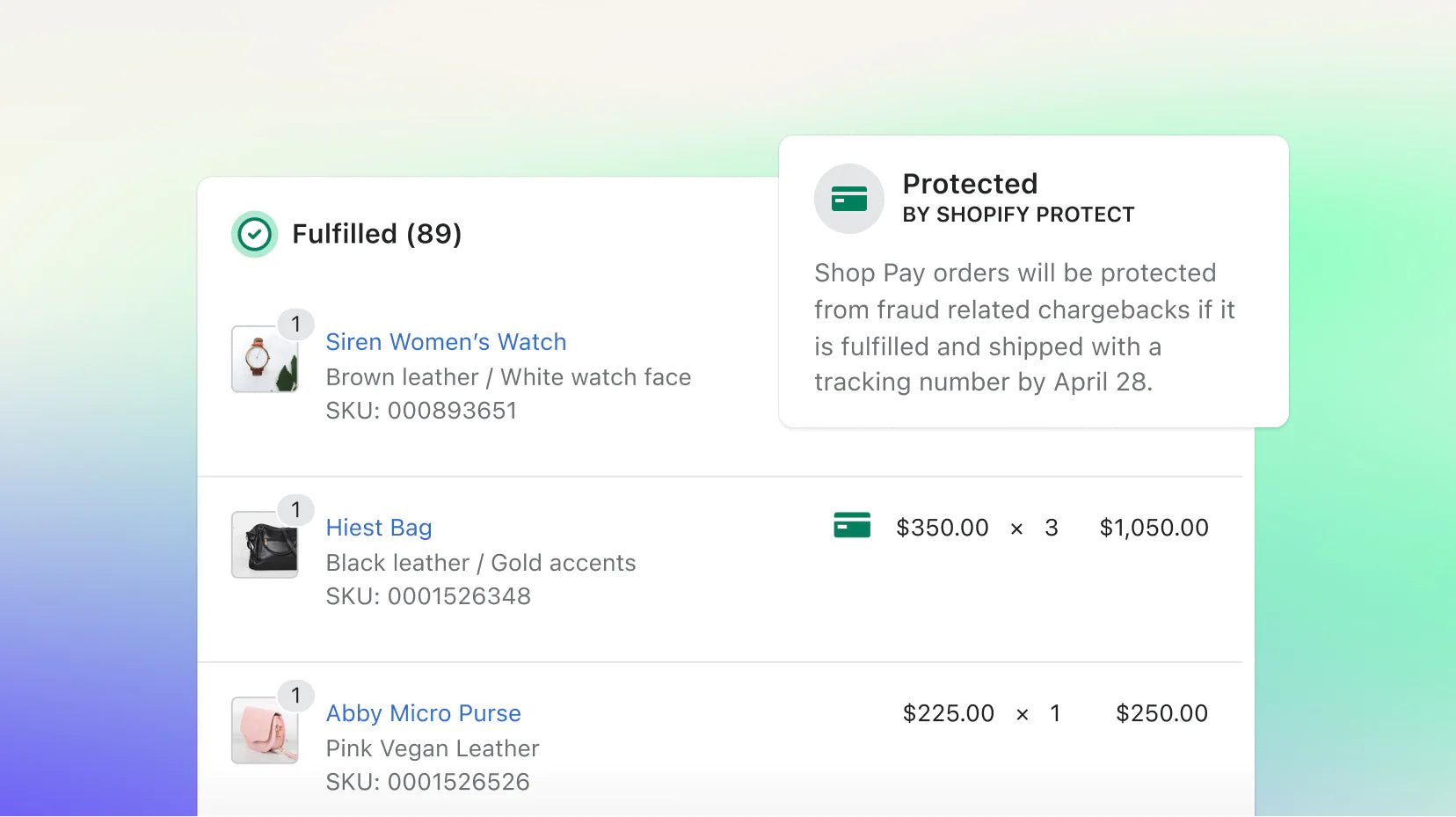

Mobile payments are highly secure. Mobile devices often require authentication methods such as fingerprints or facial recognition, and the transactions themselves are encrypted to protect customer data. With features like Shopify Protect, which includes free fraud protection on eligible orders, you can ensure a secure payment experience for your customers.

Speed of transaction

Mobile payments are lightning-fast, allowing financial institutions to process payments almost instantly. By accepting mobile payments, you can provide a quick and efficient checkout experience for your customers, enhancing their satisfaction.

Popularity among consumers

The popularity of mobile payments is skyrocketing. Reports suggest that by 2027, global consumers will spend a staggering $6,007 billion per year through mobile payments. Embracing this trend allows you to tap into a growing market and attract more customers to your business.

Accept mobile payments for your business

As more shopping moves to mobile platforms, it’s crucial for businesses to adapt and accept mobile payments. By doing so, you provide your customers with a seamless and secure payment experience while reaping the benefits yourself. Merchants can choose from various mobile payment apps, such as mobile wallets, peer-to-peer payment apps, or leverage platforms like Shopify’s POS Go to accept mobile payments on the go.

With the convenience, security, and popularity that mobile payments offer, it’s clear that this payment method is here to stay. By incorporating mobile payments into your business operations, you can stay ahead of the curve and cater to the evolving needs of your customers.

💡Learn more about POS systems for mobile payments:

- What POS hardware do stores need?

- How to choose the best POS system

- What is a mobile POS system?

- Why do small businesses need a POS system?

- Learn how Shopify POS can help your business accept mobile payments

FAQs

Q: Are mobile payments secure?

A: Yes, mobile payments are among the most secure forms of commerce. Mobile devices require authentication and encrypt transactions, minimizing the risk of data breaches.

Q: What are the most popular mobile payment apps?

A: Some popular mobile payment apps include Apple Pay, Google Pay, Venmo, PayPal, CashApp, and Zelle.

Q: Can I accept mobile payments as a small business owner?

A: Absolutely! Small business owners can easily accept mobile payments by integrating mobile payment apps or utilizing mobile point-of-sale (mPOS) solutions like Shopify’s POS Go.

Conclusion

Mobile payments have revolutionized the way we pay for goods and services, providing convenience, security, and speed. By embracing mobile payment technology, businesses can enhance the customer experience, attract a wider customer base, and stay ahead of the evolving payment landscape. Choose the mobile payment method that suits your business needs and unlock the benefits that mobile payments offer.